Equity release is a financial solution tailored for individuals typically aged 60 and above who find themselves asset-rich but cash-poor, often due to substantial equity tied up in their homes.

These customers may have spent years diligently paying off mortgages, only to realise that their retirement income is insufficient to meet their desired lifestyle or financial needs.

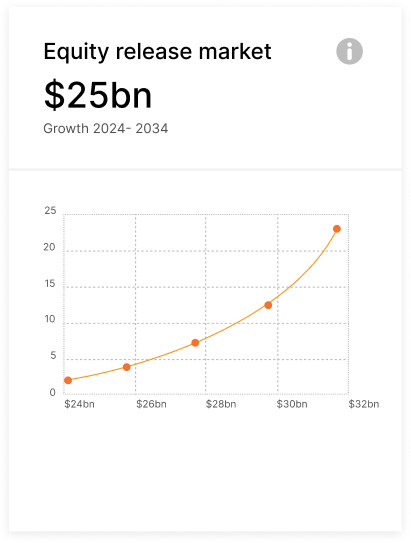

The European Equity Release Market is predicted to grow from $2bn in 2023 to $25bn in 2034.

As populations age, there is an increasing number of older homeowners who have substantial equity tied up in their properties.

With longer life expectancy, retirees seek ways to supplement their retirement income and maintain their desired standard of living.

Many retirees find themselves with insufficient pension savings to support their retirement needs.

As a result, they turn to alternative sources of income, such as equity release, to bridge the gap between their retirement income and expenses.

Many retirees find themselves with insufficient pension savings to support their retirement needs.

As a result, they turn to alternative sources of income, such as equity release, to bridge the gap between their retirement income and expenses.

In regions where property values have appreciated significantly over the years, homeowners may find themselves with substantial equity in their homes.

Equity release allows them to unlock this wealth without having to sell or downsize their properties.

Older homeowners may have financial goals or aspirations, such as home renovations, travel, or supporting family members financially.

Equity release provides them with the means to access the cash tied up in their homes to fulfill these objectives.

Traditional attitudes toward inheritance are evolving, with some older homeowners preferring to use their wealth to enhance their own quality of life rather than leaving a larger inheritance for their heirs.

Equity release offers them the opportunity to enjoy their assets while still alive.

Traditional attitudes toward inheritance are evolving, with some older homeowners preferring to use their wealth to enhance their own quality of life rather than leaving a larger inheritance for their heirs.

Equity release offers them the opportunity to enjoy their assets while still alive.

High rates of homeownership, particularly among older age groups, contribute to the potential pool of equity release customers.

With a large proportion of older individuals owning their homes outright or having substantial equity, there is a significant market for equity release products.

Overall, these socio-demographic factors, combined with evolving attitudes toward retirement and inheritance, are driving the growing demand for equity release products as a means for older homeowners to unlock the value of their homes and secure their financial futures.

1. Retirees with Limited Pension Income:

Many retirees rely solely on their pension funds, which may not be sufficient to cover expenses or enjoy a comfortable retirement.

2. Homeowners with Substantial Property Wealth:

Customers who own their homes outright or have significant equity built up in their properties but have limited liquid assets.

3. Desire for Additional Income:

Individuals seeking a supplementary income stream to support their retirement lifestyle, fund home renovations, travel, or help family members financially.

4. Wish to Stay in Their Homes:

Most equity release customers have a strong emotional attachment to their homes and wish to remain in them for as long as possible, rather than downsizing or moving into alternative accommodation.

5. Avoiding Inheritance Tax:

Some customers may wish to reduce the value of their estate for inheritance tax purposes, allowing them to pass on more wealth to their heirs.

Equity release provides a lifeline for older homeowners facing financial challenges in retirement by offering them a means to unlock the value of their homes, enhance their quality of life, and achieve greater financial security without having to leave their cherished homes.

Equity release allows homeowners to access the wealth tied up in their homes without having to sell or move out of their properties.

This enables them to unlock capital to fund various expenses or aspirations.

Customers can choose how they receive the released equity, whether as a lump sum, regular payments, or a combination of both, providing flexibility to meet their specific financial needs.

Unlike traditional mortgages, equity release typically does not require monthly repayments.

Instead, the loan, plus accrued interest, is repaid when the property is sold, usually upon the homeowner's death or move into long-term care.

Equity release schemes often include a "lifetime lease" or "lifetime tenancy" agreement, guaranteeing homeowners the right to live in their properties rent-free for the rest of their lives.

Many equity release products offer a "no negative equity guarantee," ensuring that homeowners or their heirs will not be liable for any shortfall if the eventual sale proceeds are insufficient to repay the loan.